nj bait tax form

The credit may not reduce the tax liability below the statutory minimum tax. Pass-Through Business Alternative Income Tax Act.

Time To Check Your Withholdings Irs Updates Form W 4 Marcum Llp Accountants And Advisors

Out-Of-State Winery License For Direct Ship Wine Sales to New Jersey.

. Atlantic City Luxury Tax. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. In January 2020 New Jersey enacted the Pass-Through Business Alternative Income Tax BAIT.

Pass-Through Business Alternative Income Tax Act. Landfill Closure and Contingency Tax. The New Jersey pass-through entity tax took effect Jan.

Cape May County Tourism Sales Tax. New Jersey enacted the Business Alternative Income Tax BAIT in early 2020 in response to the federal 10000 limitation on the deductibility of state and local taxes. Since the passage of the legislation the NJ Division of Taxation has created and updated its Frequently Asked Questions which contain general information about the BAIT as well as information on making the election making estimated tax payments and calculating the tax.

Members will include a copy of the Schedule PTE-K-1 with their New Jersey Gross Income Tax or Corporation. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. 1418750 42380 900000-250000 650000 x 652 42380 5656750.

This webinar will include a discussion about the effects of the NJ BAIT and federal guidance the IRS has provided after its recent acceptance of NJ BAIT tax deduction in its release of Notice 2020-75. The New Jersey elective pass-through entity PTE tax known as the Business Alternative Income Tax or NJ BAIT became effective for tax years beginning on or after January 1 2020 but was revised on Jan 18 2022 with the changes placed into effect for January 1 2022. By Jason Rosenberg CPA Withum January 15 2021.

This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. Starting with the 2021 reporting year the BAIT computation begins with New Jersey taxable income and results in better alignment with the owners New Jersey tax liability. The Tax Cuts and Jobs Act TCJA limits the itemized deduction for state and local taxes.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business. The New Jersey pass-through entity tax took effect Jan. Tax is imposed on the sum of each members share of distributive proceeds which is 900000.

A national trend ensuing the Tax Cuts and Jobs Act TCJA has been states attempts to circumvent the 10000 state and local tax SALT deduction limitation. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. It is used to offset the tax on the individual return.

Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub. The New Jersey pass-through entity tax took effect Jan.

NJ BAIT Deduction on Form 1040. No Matter What Your Tax Situation Is TurboTax Has You Covered. New Jersey is one of the latest states to enact such a SALT workaround using an entity-level tax known as the Pass-Through Business Alternative Income.

PL2019 c320 enacted the Pass-Through Business Alternative Income Tax Act effective for tax years beginning on or after January 1 2020. Casino Gross Revenue Tax. Public Community Water System Tax.

Pass-Through Business Alternative Income Tax PTEBAIT Petroleum Products Tax. Using the table above tax is calculated on the 900000 as follows. Assume a PTE filed its 2021 BAIT return on March 1 2022.

That BAIT Tax sure sounded like a can of worms. The elective entity tax. Returns due between March 15 2022 and June 15 2022 are now due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments.

The credit seems to be a state income tax payment made by the entity and then passed over to the individuals as a credit towards their tax liability. I have not indicated anywhere while using TT that I wanted to opt-out. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business.

Casino Hotel Room Fee. 9-1-1 System and Emergency Response Fee. They must also pro-vide Schedule PTE-K-1 to each member reporting the amount of the members share of distributive proceeds and Pass-Through Business Alternative Income Tax.

New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub. March 5 2021. This legislation generated only passing interest from the taxpaying community until the Internal Revenue Services IRSs November release of Notice 2020-75 in which it expressed a favorable view toward state-sponsored pass-through entity PTE state.

For New Jersey purposes income and losses of a pass-through entity are passed through to its. Form PTE-100 and pay the tax due. Im sure the OP knows more about it than I do and I dont use.

The following are. A partnership with a fiscal year of 1012193022 will file a 2021 PTE-100. NJ Bait and New SALT Guidance.

Pass-Through Business Alternative Income Tax PTEBAIT Sales and Use Tax. BAIT Extension Information. However pass-through entities may elect to pay a Pass-Through Business Alternative Income Tax due on the sum of each of the members share of distributive proceeds.

What You Need to Know. PTEs wishing to pay the BAIT will be required to make quarterly estimated tax payments which. The legislation enables pass-through business owners to take a deduction for state and local taxes paid at the entity level creditable to an individual or corporate owners New.

Casino Hotel Room Occupancy Surcharge. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. New Jersey Apportionment For tax year 2021 S corporations calculating their BAIT tax base may use either the default apportionment method for S corporations which is a single-sales.

So I looked it up and it seems that New Jersey has a new way to tax Pass Through Entities with a Business Alternatives Income Tax Makes me glad I live in a state where I can pump my own gas. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. I will post an additional problem s I found in NJ-1040 forms separately as follows.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and. NJ-1040 is not printed out for review AND NJ-1040 indicates a tax preparer was involved WAS NOT and the tax preparer and I are opting out of filing electronically.

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

Average Tax Refunds Higher Than Last Year But Paper Headaches Remain

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Army Veteranowned Taxbusiness Mobile Tax Associates Tax Consulting Veteran Owned Business Tax Preparation

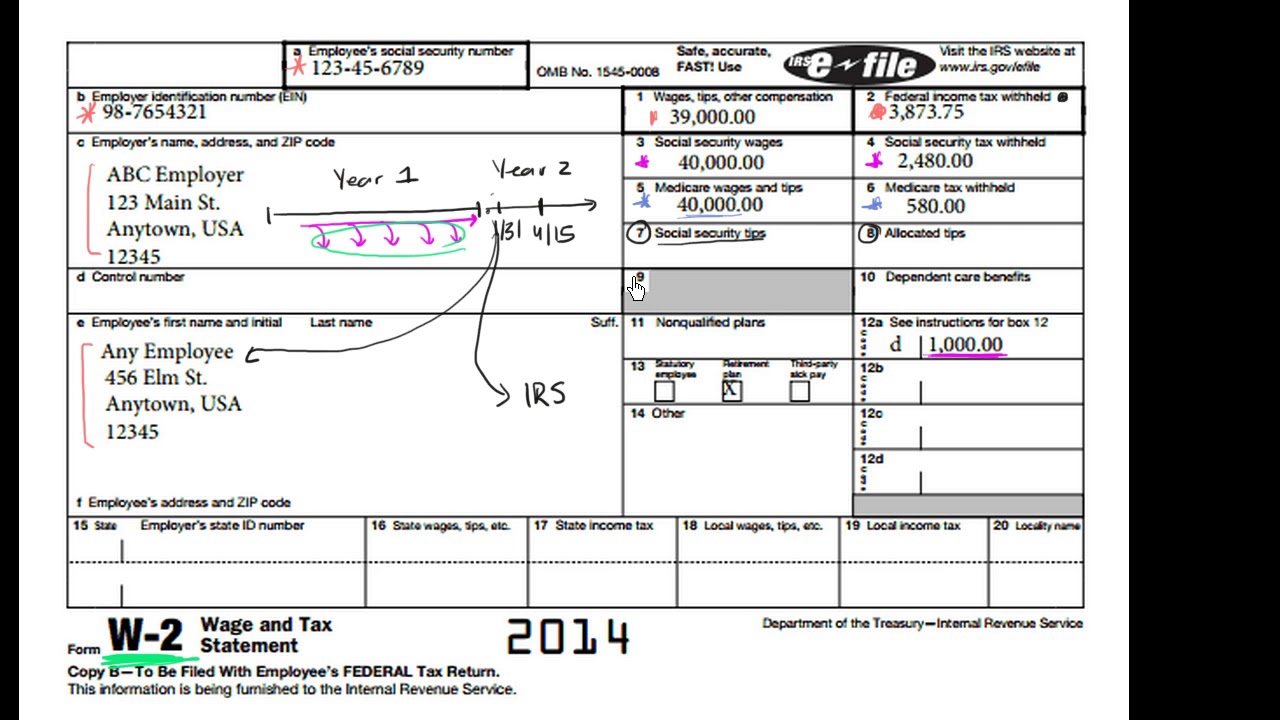

Intro To The W 2 Video Tax Forms Khan Academy

New Jersey Pass Through Business Alternative Income Tax Act Curchin Nj Cpa

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition School Address Private School

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

Form Antd Example 1 Facts You Never Knew About Form Antd Example In 2022 Are You The One Facts Personal Theme

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Bait Money Register Fill Online Printable Fillable Blank Pdffiller

Administrative Proposal Would Tax Excess Returns From Outbound Ip Transfers Marcum Llp Accountants And Advisors

Worried About A Tax Audit Avoid These Irs Red Flags

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Nj Bait Forms Have Been Released News Levine Jacobs Co

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan